Introduction

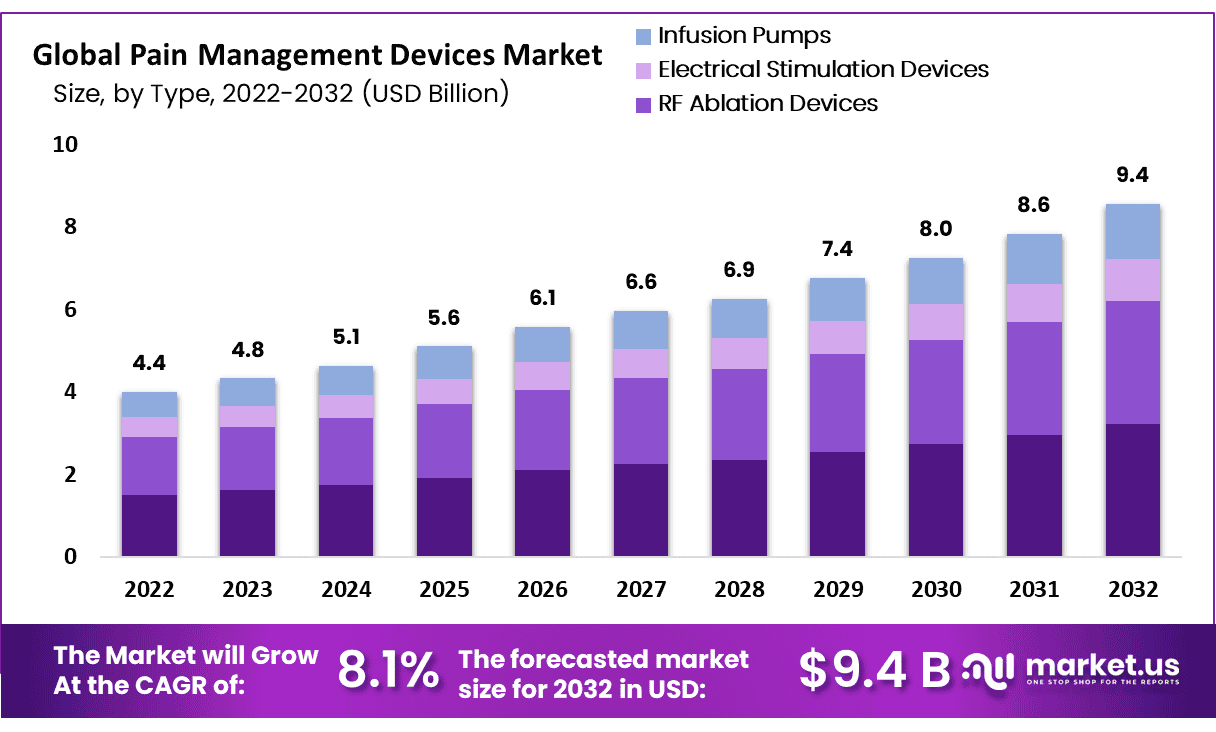

The Global Pain Management Devices Market is poised for substantial growth, with forecasts projecting an expansion from USD 4.4 billion in 2022 to approximately USD 9.4 billion by 2032. This growth, representing a compound annual growth rate (CAGR) of 8.1% from 2023 to 2032, is primarily driven by technological advancements, a rising prevalence of chronic pain, and a shift towards non-pharmacological treatments. Innovations in device technology, such as wearable and smart devices offering personalized management and real-time feedback, are enhancing the effectiveness and user experience of pain management solutions.

The increasing incidence of chronic pain, fueled by an aging global population, is significantly boosting the demand for effective pain management devices. Conditions such as arthritis, diabetic neuropathy, and back pain are among the most common, necessitating advanced solutions in pain management. Additionally, there is a notable trend towards minimizing reliance on pharmaceutical treatments, partly due to the opioid crisis. This shift is fostering greater interest in alternative therapies like transcutaneous electrical nerve stimulation (TENS) and spinal cord stimulation.

Market growth is also supported by enhanced healthcare infrastructure and increased health service spending, particularly in emerging markets. This improved accessibility, coupled with initiatives by both government and private sectors, is integrating advanced pain management solutions into mainstream healthcare systems. Furthermore, an informed patient base, empowered by readily available online information, is more inclined to explore and adopt innovative pain management devices.

In April 2024, Medtronic received FDA approval for its Inceptiv™ closed-loop rechargeable spinal cord stimulator (SCS), a significant innovation with the potential to transform chronic pain management. This device adjusts automatically to changes in spinal cord signals, enhancing patient outcomes. Another noteworthy development occurred in March 2023 when Abbott introduced its Eterna™ SCS System in Canada, following Health Canada’s approval. Distinguished by its minimal recharge requirement, this device underscores a trend towards user-friendly pain management solutions.

In alignment with the digital transformation in healthcare, OMRON Healthcare expanded its capabilities by acquiring Luscii Healthtech in April 2024. This move strengthens OMRON’s presence in remote patient monitoring and digital health services, essential for the evolving landscape of pain management. Luscii’s platform, which supports over 150 diseases, helps in reducing unplanned hospital admissions and lowers healthcare costs, thereby contributing to the broader accessibility and efficiency of chronic condition management.

Key Takeaways

- The market is projected to grow from USD 4.4 billion in 2022 to USD 9.4 billion by 2032, showing a CAGR of 8.1%.

- The rising prevalence of chronic diseases such as diabetes and obesity is boosting demand for pain management devices.

- The expanding elderly population is increasingly requiring chronic pain management solutions.

- Neuromodulation and neurostimulation devices were the leading segments, accounting for a 37.6% revenue share in 2022.

- Neuropathic pain was the primary application, holding a 28% revenue share, largely due to the aging population.

- North America was the market leader in 2022, with Europe and Asia-Pacific expected to see significant growth driven by tech adoption and healthcare improvements.

- High costs and product recalls are major market constraints, impacting device accessibility and consumer trust.

- Advances in TENS technology and heightened awareness of chronic pain are key drivers for market growth.

- Economic inflation is affecting healthcare expenses, potentially restricting access to advanced pain management devices due to cost issues.

Pain Management Devices Statistics

Prevalence of Chronic Pain

- Around 20.5% of American adults, approximately 50.2 million, are affected by chronic pain.

- Globally, about 1.9 billion people exhibit chronic pain symptoms, including common issues like tension-type headaches.

- Over 100 million Americans experience chronic pain daily.

- Chronic pain affects more than 30% of the global population; in China, it affects 300 million people, with a higher prevalence among the young.

Financial and Medical Resource Implications

- Approximately $17.8 billion is spent annually on pain medication prescriptions in the U.S.

- Over $33 billion has been invested in digital health solutions over the past decade, now utilized by 90% of the population in some form.

- In China, the ratio of medical professionals is notably low, with only 2 doctors per 1,000 people.

Trends in Pain Management and Treatment

- From 2020 to 2022, West China Internet Hospital recorded 5,088 online pain-related visits, making up 12.9% of all such consultations.

- Offline consultations at this hospital are more frequent among middle-aged individuals, comprising 44.8% of visits.

- The average age of patients for online and offline visits are 46.85 and 51.48 years, respectively.

- Women tend to utilize pain outpatient services equally through both online and offline modes.

- Most online patients (51.8%) do not reside in Chengdu, whereas 57.8% of offline patients live locally.

Occupational and Demographic Insights

- A significant 45.9% of online consultations are by young individuals, indicating their preference for digital solutions.

- About 60.1% of online patients are employed, with ‘farmer’ being the most common occupation among patients.

- Common diagnoses online include headaches (5.6%), osteoporosis (5.0%), and cancer pain (4.6%).

- Offline clinics frequently deal with herpes zoster-related neuralgia (23.4%), osteoporosis (20.9%), and cancer pain (16.6%).

Pain in Cancer Treatment

- Breakthrough pain affects 40% to 80% of cancer patients, with varying occurrence rates based on the treatment stage and setting.

- Pain incidence ranges from 58% to 69% in advanced cancer stages, significantly impacting daily life in 80% of these cases.

- Most pain episodes (60%) occur in the late morning, highlighting potential timing for therapeutic interventions.

Pharmacological Management

- Recent data shows a reduction in the prescription of opioids; 25,000 fewer individuals are prescribed opioids for longer than three months as of March 2024.

- There’s a decrease in high-dose opioid prescriptions, with 4,500 fewer individuals receiving such treatments compared to the previous year.

- Patient Safety Collaboratives in England are working towards reducing opioid use for chronic pain by the end of March 2025.

Bioavailability and Efficacy of Treatments

- Fast-dissolving buccal tablets (FBT) demonstrate a 65% bioavailability, with 48% absorbed by the buccal mucosa, impacting pain as early as 10 minutes post-administration.

- Sublingual films (SLF) show a slightly higher bioavailability at 70%, due to rapid absorption through the sublingual mucosa.

Emerging Trends

- Multimodal Pain Management: With the increasing awareness of opioid misuse, there is a notable shift towards multimodal pain management strategies. This approach utilizes multiple drug classes to minimize or completely avoid opioid use. By integrating various medications and interventional procedures, multimodal pain management can control pain more effectively while reducing the risks of dependency. This strategy is becoming essential in addressing the complexities of pain without the associated risks of opioid addiction.

- Technology-Enhanced Solutions: Technological innovations are increasingly pivotal in the pain management sector. Devices that employ electronic signals to intercept pain messages before they reach the brain are gaining popularity. Further, the development of wearable pain management devices offers patients continuous and self-managed therapy options. These advancements allow for more controlled and accessible pain relief, marking a significant trend in medical technology.

- Personalized Pain Management: The trend towards personalized pain management is growing, focusing on tailoring pain control strategies to individual patient needs. Personalization often involves genetic testing to determine how different individuals respond to pain medications. This can lead to adjustments in treatment plans, enhancing the effectiveness of pain relief and minimizing side effects. This patient-centered approach is reshaping pain management practices by aligning treatment strategies with individual genetic profiles.

- Non-Opioid Therapies: In response to the opioid crisis, there is a vigorous trend towards the development and use of non-opioid therapies. Alternatives such as gabapentinoids and non-drug therapies like electrical nerve stimulation are proving effective in managing pain without the addiction risks tied to opioids. This trend reflects a critical shift in pain management, emphasizing safer therapeutic options that mitigate the potential for abuse and addiction.

Use Cases

- Chronic Pain Management: Transcutaneous Electrical Nerve Stimulation (TENS) units are essential for managing chronic pain, such as arthritis, fibromyalgia, and lower back pain. These devices send small electrical pulses through the skin, aiming to alleviate discomfort. This method offers a non-invasive alternative to medication, potentially reducing pain and enhancing daily functioning for individuals with chronic conditions.

- Postoperative Pain: Managing pain after surgery is vital for effective recovery. Pain management devices play a crucial role by providing controlled medication doses or nerve stimulation. This approach not only helps minimize the use of opioid medications but also accelerates the recovery process, ensuring patients can return to normal activities sooner.

- Neuropathic Pain: Devices designed for neuropathic pain, like those experienced in diabetic neuropathy, modulate nerve activity to control discomfort. These devices adjust nerve signals, providing relief where traditional medications fall short. This is especially significant for patients who do not respond well to standard pain treatments, offering them a viable alternative for pain management.

- Cancer Pain: In the realm of cancer treatment, pain management devices are indispensable. They deliver relief either directly to the targeted area or throughout the body. This method significantly enhances the quality of life for patients by managing severe and continuous pain, reducing the dependence on systemic opioids which can be fraught with side effects.

- Elderly Care: Pain management devices are particularly beneficial in elderly care, where patients may be more susceptible to the adverse effects of drugs. These devices offer a safer alternative for managing chronic pain, avoiding the risks associated with traditional drug therapies. This is particularly crucial considering the complex medication regimens often required in elderly care, helping to reduce potential drug interactions and side effects.

Conclusion

The global market for pain management devices is set to experience significant growth due to several factors including technological innovations, an increase in chronic pain cases, and a shift towards non-pharmacological treatments. These devices, which range from wearable technologies to advanced stimulation systems, are becoming increasingly crucial in managing pain effectively. The drive towards minimizing opioid reliance also propels the demand for these alternative therapies. As healthcare systems continue to evolve, integrating sophisticated pain management solutions will become more prevalent, helping to improve the quality of life for patients globally. This market is poised for expansion, reflecting a growing acknowledgment of the need for effective and personalized pain management strategies.

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)